Personal Finance

Personal finance is about taking control of your money. It involves understanding your current financial situation, setting goals for the future (like saving for a house or retirement), managing your everyday finances (like budgeting and paying bills), and creating a safety net with an emergency fund.

Latest Advice

Dec 30, 2025

Aug 2, 2025

Aug 5, 2025

Jun 10, 2025

Theft Protection

May 30, 2025

Feb 23, 2024

Apr 21, 2025

Jan 25, 2024

Dec 20, 2023

IdentityTheft.gov is the U.S. federal government's one-stop resource for identity theft victims. It provides step-by-step guidance to report identity theft and develop a personalized recovery plan. The website offers tools to create necessary reports and letters for credit bureaus and businesses, helping users regain control of their personal information and prevent further fraud.

You can also file a report over the phone at 877-438-4338

By law, you can get a free credit report each year from the three credit reporting agencies (CRAs). These agencies include Equifax, Experian, and TransUnion.

AnnualCreditReport.com is the only website authorized by the federal government to issue free, annual credit reports from the three CRAs. You may request your reports:

-

Online by visiting AnnualCreditReport.com

-

By calling 1-877-322-8228 (TTY: 1-800-821-7232)

-

By filling out the Annual Credit Report request form and mailing it to:

-

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

-

If you're a victim of identity theft, act quickly to protect your finances. Report the theft at IdentityTheft.gov, place a fraud alert or credit freeze with credit agencies, review your credit reports for unauthorized activity, and contact affected companies to address fraudulent accounts. File a police report if necessary, and monitor your accounts regularly for unusual activity.

Budget & Debt

Having a budget and improving your credit score are essential tools for financial success. They give you control, open doors to opportunities, and save you money throughout your life.

Jun 4, 2025

Jan 16, 2025

Apr 2, 2025

Sep 20, 2024

The LendingTree article "How to Get Out of Debt" provides comprehensive strategies for managing and eliminating debt.

NerdWallet's article "The Best Budget Apps for 2025" reviews several budgeting applications to help users manage their finances effectively.

NerdWallet's "Free Budget Planner Worksheet" is a practical tool designed to help individuals manage their finances by organizing income and expenses

Credit Score

A good credit score increases access to loans and credit, lowers interest rates, improves loan terms, and facilitates renting. It can enhance job prospects, reduce insurance premiums, provide financial flexibility, and help in emergencies while avoiding security deposits

Jun 4, 2025

Jan 23, 2025

Retirement

Retirement is important because it safeguards your financial well-being, independence, and quality of life in your later years, allowing you to enjoy retirement on your terms without unnecessary worry or burden on others

Aug 3, 2025

Sep 4, 2024

Jul 23, 2025

May 17, 2024

May 28, 2025

Kiplinger's article "12 Retirement Moves to Make This Year" outlines essential steps to enhance your retirement readiness in 2025.

AARP's article "9 Ways Retirement Will Be Different in 2025" outlines several key changes that will impact retirees.

Fidelity's article "Savvy tax withdrawals" emphasizes the importance of strategic withdrawal planning in retirement to optimize tax efficiency.

Estate planning

Estate planning ensures your assets are distributed as you wish, minimizes taxes, avoids probate, and protects dependents. It includes healthcare decisions, ensures business continuity, honors personal wishes, and provides peace of mind for you and your loved ones.

Oct 24, 2024

May 13, 2024

Seasonal Finances

Seasonal finances are important because many expenses and income patterns change depending on the time of year. Planning for these shifts helps people and businesses avoid financial stress and stay prepared.

Dec 4, 2024

Jun 16, 2025

Sep 3, 2025

Apr 2, 2025

Jun 10, 2025

Dec 17, 2024

Kids & Teens

Teaching children about money builds financial literacy, fosters good habits, and prepares them for real-life responsibilities. It promotes independence, helps them understand opportunity costs, and reduces the risk of financial stress. Additionally, it encourages generosity and responsible decision-making.

Aug 20, 2025

May 5, 2023

Jan 22, 2024

Apr 24, 2023

Aug 13, 2025

The "Kidpreneur" section of PasoEdu.com offers resources to inspire and educate children about entrepreneurship.

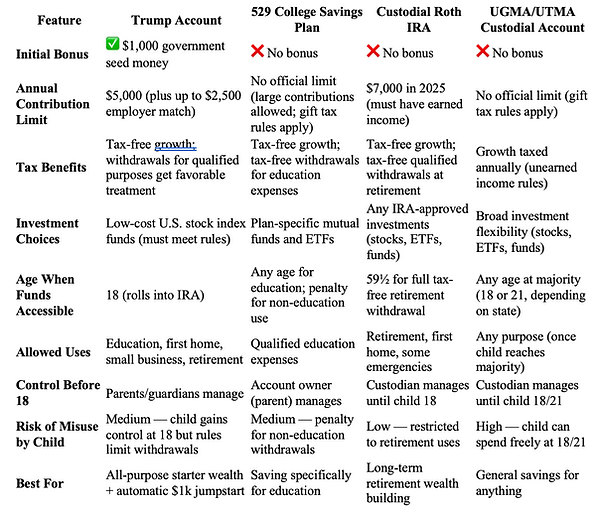

The best investment account depends on your child’s needs—whether you’re saving for education, teaching investing basics, or building long-term wealth. Early investing leverages compound growth, and each account type offers unique tax benefits and flexibility.

The article "12 Toys, Games, & Other Items I'm Using to Teach My Kids & Students About Money, Starting at $6" by Jacquelyn Smith, published on January 11, 2025, presents a curated list of affordable educational tools designed to teach children essential financial skills. Drawing from her experience as a parent and teacher, Smith emphasizes the importance of introducing financial education early to help kids make wise financial decisions in the future. Each recommended item is priced under $30, making them accessible for families and educators.

Debit cards for kids and teens are effective tools for fostering financial responsibility with parental oversight and educational resources. They provide a safe way for young people to gain hands-on experience managing money.

CNBC Select highlights the top investment accounts for kids, emphasizing that starting early can maximize wealth growth and instill strong saving habits. The best account for your child depends on your primary objective—such as saving for education or retirement.

Experts note that while everyone eligible should claim the free $1,000, other tools like 529 college savings plans, custodial accounts, or Roth IRAs offer more flexibility and better tax benefits for long-term savings or education goals.